As filed with the Securities and Exchange Commission on October 10, 2023

Registration No. 333-273830

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_________________

_________________

| | 7310 | 86-2062844 | ||

| (State or Other Jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

250 S. Australian Avenue, Suite 1300

West Palm Beach, Florida 33401

(877) 776-2402

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

_________________

Michael Seifert

President and Chief Executive Officer

PSQ Holdings, Inc.

250 S. Australian Avenue, Suite 1300

West Palm Beach, Florida 33401

(877) 776-2402

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

_________________

With copies to:

|

Stephen Moran |

Jonathan Talcott |

_________________

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| | ☒ | Smaller reporting company | | |||

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where such offer or sale is not permitted.

Subject to completion, dated October 10, 2023

Preliminary Prospectus

PSQ HOLDINGS, INC.

Primary Offering

11,450,000 Shares of Class A Common Stock Issuable

Upon the Exercise of Warrants

Secondary Offering

10,012,500 Shares of Class A Common Stock

5,700,000 Warrants to Purchase Class A Common Stock

This prospectus relates to the issuance by us of up to 11,450,000 shares of Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”) of PSQ Holdings, Inc., a Delaware corporation (the “we,” “us” and “our”), that may be issued upon exercise of 5,750,000 Public Warrants (as defined herein) to purchase Class A Common Stock issued as part of the Units (as defined herein) in our IPO (as defined herein) and 5,700,000 Private Warrants (as defined herein) to purchase Class A Common Stock at an exercise price of $11.50 per share of Class A Common Stock issued to the Colombier Sponsor (as defined herein) in connection with our IPO at a purchase price of $1.00 per Private Warrant, which Private Warrants may be exercised by the Colombier Sponsor and the Colombier Sponsor Distributees (as defined herein) on a cashless basis. The Public Warrants and the Private Warrants are referred to in this Prospectus as the “Warrants”. The Warrants have an exercise price of $11.50 per share. The Public Warrants are generally exercisable only for cash, subject to the right of holders to exercise the Public Warrants on a cashless basis under certain limited circumstances provided for in the Warrant Agreement (as defined herein) relating to the Warrants. The Private Warrants are exercisable by the Colombier Sponsor, the Sponsor Distributees and certain other permitted transferees on a cashless basis as provided in the Warrant Agreement.

In addition, this prospectus also relates to the offer and sale, from time to time, by the selling security holders identified in this prospectus (such selling security holders and their permitted transferees, the “Selling Holders”) of (i) up to 4,312,500 shares of Class A Common Stock currently outstanding, or the Colombier Sponsor Shares (as defined herein), that were issued upon conversion of the Colombier Class B Common Stock (as defined herein) in connection with the Closing of the Business Combination (as defined herein), which were originally acquired by the Colombier Sponsor for an aggregate purchase price of $25,000, or approximately $0.006 per share, and subsequently distributed by the Colombier Sponsor to the Sponsor Distributees for no additional consideration, (ii) up to 5,700,000 Private Warrants and (iii) up to 5,700,000 shares of Class A Common Stock issuable upon the exercise of Private Warrants.

This prospectus provides you with a general description of such securities and the general manner in which we and the Selling Holders may offer or sell the securities. More specific terms of any securities that we and the Selling Holders may offer or sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus.

We will not receive any proceeds from the issuance of shares of Class A Common Stock upon the exercise of the Warrants unless the holders of the Warrants exercise their Warrants for cash. Cash proceeds associated with the exercises of our Warrants, if any, are highly dependent on the price of our Class A common stock and the spread between the exercise price of the Warrant and the price of our Class A common stock at the time of exercise. For example, to the extent that the price of our Class A common stock exceeds $11.50 per share, it is more likely that

holders of our Warrants will exercise their warrants. If the price of our Class A common stock is less than $11.50 per share, we believe it is much less likely that such holders will exercise their warrants. On October 3, 2023, the closing price of the Class A Common Stock as reported by The New York Stock Exchange (the “NYSE”) was $8.45 per share, which price was less than the $11.50 per share exercise price of the Private Warrants. There can be no assurance that our Warrants will be in the money after the date of this prospectus and prior to their expiration. Our Sponsor and the Sponsor Distributees have the option to exercise the Private Warrants on a cashless basis. Holders of Public Warrants may generally only exercise such Warrants for cash, subject to very limited exceptions in certain circumstances as provided for in the Warrant Agreement relating to the Warrants. See “Use of Proceeds.” Our registration of the shares of Class A Common Stock covered by this prospectus does not mean that we will issue or sell any of the shares of Class A Common Stock. We will bear all costs, expenses and fees in connection with the registration of the shares of Class A Common Stock underlying the Warrants. We provide more information about how we may sell the shares of Class A Common Stock in the section entitled “Plan of Distribution.”

The securities registered for resale by the Selling Holders in the registration statement of which this prospectus forms a part represent approximately 25.7% of our total shares outstanding (assuming the exercise of all of the outstanding Warrants for cash and no issuance of any Earnout Shares) and will therefore constitute a considerable percentage of our public float and will be available for immediate resale upon effectiveness of the registration statement and for so long as such registration statement remains available, subject to the expiration of the Lock-Up Period (as defined below), as applicable, or sooner in the case of the Private Warrants and shares of Class A Common Stock that may be issued upon exercise of the Private Warrants. The market price of shares of our Class A Common Stock could decline as a result of substantial sales of our Class A Common Stock by our Selling Holders or the perception in the market that holders of a large number of shares intend to sell their shares. Sales of a substantial number of shares of our Class A Common Stock in the public market could occur at any time. In addition, the Selling Holders purchased the securities covered by this prospectus at different prices, some at prices significantly below the current trading price of such securities. For example, the Colombier Sponsor (as defined herein) purchased its 4,312,500 shares of Class A Common Stock currently outstanding, or the Colombier Sponsor Shares, for an aggregate purchase price of $25,000, or approximately $0.006 per share. Accordingly, the Sponsor Distributees would potentially earn approximately $36.4 million of profit in the aggregate (before giving effect to any brokerage or other transaction costs that may be incurred by them in connection with any such resales) upon resale of all of the shares of Class A Common Stock constituting the Colombier Sponsor Shares that they received upon conversion of their Colombier Class B Common Stock in connection with the Closing of the Business Combination if they were to sell their shares at a price of $8.45, the closing price of the Class A Common Stock as reported by the NYSE on October 3, 2023. The Sponsor Distributees also hold 5,700,000 Private Warrants, which were purchased by the Colombier Sponsor at a price of $1.00 per warrant in connection with our IPO. Accordingly, the Sponsor Distributees could earn approximately $1.0 million of profit in the aggregate (before giving to any brokerage or other transaction costs that may be incurred by them in connection with any such resales) upon resale of their Private Warrants if they were to sell such Private Warrants at a price equal to $1.17, which was the closing price of Public Warrants as reported by the NYSE on October 3, 2023. On October 3, 2023, the closing price of the Class A Common Stock on the NYSE was $8.45 per share, which price was less than the $11.50 per share exercise price of the Private Warrants. Assuming the Sponsor Distributees exercised all of the Private Warrants on a cashless basis on August 9, 2023, the most recent day prior to the date of this prospectus on which either the “Fair Market Value” (as defined in the Warrant Agreement) of our Class A Common Stock or the closing price of the Class A Common Stock as reported by the NYSE exceeded $12.50 per share (which amount represents the exercise price of $11.50 per share of Class A Common Stock plus the $1.00 purchase price paid by the Colombier Sponsor for each Private Warrant) and immediately sold the 730,326 shares of Class A Common Stock that would have been acquired upon such cashless exercise (based on a Fair Market Value of our Class A Common Stock on such day of $13.19 per share and which amount would have been used for purposes of calculating the number of shares issuable upon such cashless exercise), and with such sales effected at a price equal to the $10.70 closing sale price of our Class A Common Stock on the NYSE on such day, the Sponsor Distributees could have potentially earned approximately $2.1 million of profit in the aggregate (before giving effect to any brokerage or other transaction costs that may be incurred by them in connection with any such sales). The Selling Holders may potentially make a significant profit with the sale of the securities covered by this prospectus depending on the trading price of our securities at the time of a sale and the purchase price of such securities by the applicable Selling Holders. While the Selling Holders may experience a positive rate of return based on the trading price of our securities, the public holders of our securities may not experience a similar rate of return on the securities they purchased due to differences in the applicable purchase price and trading price. Sales of our Class A Common Stock by the Selling Holders, or the perception that such sales may occur, may also cause the market price of our Class A Common Stock to drop significantly, even if our business is doing well. See “Risk Factors — A significant number of shares of our Class A Common Stock and the Private Warrants will be available for public resale by the Selling Holders and, subject to the

Lock-Up Period in the case of the shares of Class A Common Stock constituting the Colombier Sponsor Shares (but not the Private Warrants or shares of Class A Common Stock issuable upon exercise thereof), may be sold into the market in the future upon effectiveness of the registration statement of which this prospectus forms part. The Selling Holders purchased the securities covered by this prospectus at different prices than prices paid by investors who purchased our securities in our IPO or in the public markets, and the prices paid by the Selling Holders were significantly below the current trading price of our securities. Sales of our Class A Common Stock by the Selling Holders, or the perception that such sales may occur, may cause the market price of our Class A Common Stock to decline, perhaps significantly, even if our business is doing well.”

Our registration of the securities covered by this prospectus does not mean that either we or the Selling Holders will issue, offer or sell, as applicable, any of the securities. The Selling Holders may offer and sell the securities covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Holders may sell the shares in the section entitled “Plan of Distribution.” In addition, certain of the securities being registered hereby are subject transfer restrictions that may prevent the Selling Holders from offering or selling such securities upon the effectiveness of the registration statement of which this prospectus is a part. See “Description of Securities” for more information.

Each share of our Class A Common Stock entitles its holder to one vote per share on all matters submitted to a vote of stockholders except as otherwise expressly provided by our Charter (as defined herein) or as provided by law. Each share of our Class C Common Stock entitles its holder, initially Mr. Michael Seifert, our Founder, President and Chief Executive Officer and Chairman of the Board, to a number of votes per share (rounded up to the nearest whole number) equal to (a) the aggregate number of outstanding shares of Class A Common Stock entitled to vote on the applicable matter as of the applicable record date plus 100, divided by (b) the aggregate number of outstanding shares of Class C Common Stock (the “Per Share Class C Voting Power”). As of the date of this prospectus, Mr. Seifert controls approximately 52.81% of our outstanding voting power due to his ownership all of our outstanding shares of Class C Common Stock and, as such, the result of most matters to be voted upon by our stockholders will be controlled by Mr. Seifert, who can base his vote upon his best judgment and his fiduciary duties to our stockholders, and who otherwise will be able to exercise a very significant degree of control over our company. In addition, we are a “controlled company” within the meaning of applicable NYSE rules as of the date of this prospectus and, consequently, qualify for exemptions from certain corporate governance requirements. As a result, our stockholders do not have the same degree of corporate governance protections under NYSE rules as those afforded to stockholders of companies that are not “controlled companies.” For additional information please see the section entitled “Management — Controlled Company”.

You should read this prospectus and any prospectus supplement or amendment carefully before investing in our securities. Our Class A Common Stock trades on the New York Stock Exchange (the “NYSE”) under the ticker symbol “PSQH” and our Warrants trade on the NYSE under the ticker symbol “PSQH.WS”. On October 3, 2023, the closing price of our Class A Common Stock as reported by NYSE was $8.45 per share and the closing price of our Public Warrants as reported by NYSE was $1.17. Each of our Warrants is exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share.

We are an emerging growth company and a smaller reporting company under the federal securities laws and, as such, are subject to certain reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company and a Smaller Reporting Company” on page 3 of this prospectus.

Investing in our Class A Common Stock and Warrants involves a high degree of risk. See the section titled “Risk Factors” beginning on page 10.

Neither the Securities and Exchange Commission (the “SEC”) nor any other state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

|

Page |

||

|

ii |

||

|

iii |

||

|

vi |

||

|

vii |

||

|

1 |

||

|

6 |

||

|

9 |

||

|

10 |

||

|

50 |

||

|

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

51 |

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

62 |

|

|

76 |

||

|

88 |

||

|

96 |

||

|

101 |

||

|

103 |

||

|

108 |

||

|

110 |

||

|

112 |

||

|

120 |

||

|

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

122 |

|

|

128 |

||

|

132 |

||

|

132 |

||

|

132 |

||

|

F-1 |

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using a “shelf” registration process. Under this shelf registration process, the Selling Holders may, from time to time, sell up to an aggregate of 10,012,500 shares of Class A Common Stock (which includes 4,312,500 shares of Class A Common Stock currently outstanding that were issued upon conversion of the Colombier Class B Common Stock in connection with the Closing of the Business Combination (or the Colombier Sponsor Shares) and up to 5,700,000 shares of Class A Common Stock issuable upon the exercise of outstanding Private Warrants) and up to 5,700,000 Private Warrants from time to time through any means described in the section entitled “Plan of Distribution.” More specific terms of any securities that the Selling Holders offer and sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the Class A Common Stock and/or Private Warrants being offered and the terms of the offering. We will not receive any proceeds from the sale by such Selling Holders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of up to an aggregate of 11,450,000 shares of Class A Common Stock upon exercise of the Warrants.

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. See “Where You Can Find More Information.”

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of Class A Common Stock and Private Warrants offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell our securities, and it is not soliciting an offer to buy our securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

On July 19, 2023 (the “Closing Date”), we consummated the transactions contemplated by that Agreement and Plan of Merger, dated as of February 27, 2023, (the “Merger Agreement”), each by and among PublicSq. Inc. (f/k/a PSQ Holdings, Inc.), a Delaware corporation (“Private PSQ”), Colombier Acquisition Corp., a Delaware corporation (“Colombier”), Colombier-Liberty Acquisition, Inc., a Delaware corporation and a wholly-owned subsidiary of Colombier (“Merger Sub”), and Colombier Sponsor, LLC (the “Colombier Sponsor”), a Delaware limited liability company, in its capacity as purchaser representative, for the purposes set forth in the Merger Agreement, which, among other things, provided for the merger of Private PSQ into Merger Sub with Private PSQ surviving the merger as a wholly owned subsidiary of Colombier (the “Business Combination”). At the closing of the Business Combination (the “Closing”), Colombier changed its name to “PSQ Holdings, Inc.”

Unless the context indicates otherwise, references to the “Company,” “we,” “us” and “our” refer to PSQ Holdings, Inc., a Delaware corporation, and its consolidated subsidiaries following the Closing of the Business Combination.

ii

FREQUENTLY USED TERMS

Unless otherwise stated in this prospectus or the context otherwise requires, references to:

In this document:

“Board” refers to the board of directors of the Company. References herein to the Company will include its subsidiaries to the extent reasonably applicable.

“Business Combination” means the business combination of Colombier and Private PSQ pursuant to the terms of the Merger Agreement and the other transactions contemplated by the Merger Agreement.

“Bylaws” means the Amended and Restated Bylaws of the Company as in effect on the date of this prospectus.

“Charter” means the Restated Charter of the Company as in effect on the date of this prospectus.

“Class A Common Stock” means the shares of Class A common stock, par value $0.0001 per share, of the Company.

“Class C Common Stock” means the shares of Class C common stock, par value $0.0001 per share, of the Company.

“Closing” means the closing of the Business Combination.

“Closing Date” means July 19, 2023.

“Common Stock” means our Class A Common Stock and Class C Common Stock together.

“Company” means PSQ Holdings, Inc., a Delaware corporation, following the Closing.

“Code” means the Internal Revenue Code of 1986, as amended.

“Colombier” means the Company prior to the Closing.

“Colombier Sponsor” means Colombier Sponsor LLC, a Delaware limited liability company.

“Colombier Class A Common Stock” means the Class A Common Stock, par value $0.0001 per share, of Colombier, prior to the Closing of the Business Combination.

“Colombier Class B Common Stock” means the Class B Common Stock, par value $0.0001 per share, of Colombier, prior to the Closing of the Business Combination.

“Colombier Common Stock” means the Colombier Class A Common Stock and Colombier Class B Common Stock.

“Colombier Sponsor Shares” means Colombier Class B Common Stock initially purchased by the Colombier Sponsor in the private placement prior to the IPO, and the shares of Class A Common Stock issued upon the conversion thereof at the Closing.

“Deemed Equity Holder” means certain executive officers, employees and service providers of the Company designated by the Company, who may be entitled to receive Earnout Shares, if issued in accordance with the terms of the Merger Agreement, in the form of an Earnout Equity Award issued by the Company from the Earnout Subpool of the Incentive Plan, provided such Deemed Equity Holder is, at the time the Earnout Shares, if any, are issued, then still providing services to the Company.

“DGCL” means the General Corporation Law of the State of Delaware, as amended.

“Earnout Equity Award” means an equity award issued by the Combined Company after the Closing to a Deemed Equity Holder from the Earnout Subpool.

“Earnout Shares” means up to 3,000,000 shares of Class A Common Stock that may be issued by the Company to Participating Equityholders upon achievement of certain trading price-based targets for the Company Common Stock following Closing.

iii

“Earnout Subpool” means up to 2,700,000 of the total number of Earnout Shares which the Company set aside and reserved for issuance by the Company under the EIP and from which any Earnout Equity Awards will be made.

“Effective Time” means the effective time of the Merger in accordance with the Merger Agreement.

“EIP” means the PSQ Holdings, Inc. 2023 Stock Incentive Plan.

“ESPP” means the PSQ Holdings, Inc. 2023 Employee Stock Purchase Plan.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“GAAP” means generally accepted accounting principles in the United States.

“Insider Letter” means the letter agreement, dated June 8, 2021, by and among Colombier, its officers and directors as of the date thereof, and the Colombier Sponsor.

“IPO” means the initial public offering of Colombier’s Units at a public offering price of $10.00 per Unit that it consummated on June 11, 2021.

“Merger” means the merger of Merger Sub with and into Private PSQ, with Private PSQ continuing as the surviving corporation and as a wholly-owned subsidiary of Colombier, in accordance with the terms of the Merger Agreement.

“Merger Agreement” means the Agreement and Plan of Merger, dated as of February 27, 2023, by and among Colombier, Merger Sub, Colombier Sponsor, as purchaser representative, and PSQ.

“NYSE” means the New York Stock Exchange.

“Participating Equityholder” means each Private PSQ Stockholder and each Deemed Equity Holder.

“Permitted Financing” means an equity or debt financing transaction or series of equity or debt financing transactions entered into by Private PSQ after the date of the Merger Agreement, by way of issuance, subscription or sale, which results in cash proceeds to Private PSQ prior to the Effective Time.

“Private PSQ” means PublicSq. Inc. (f/k/a PSQ Holdings, Inc.), a Delaware corporation, prior to the Business Combination. References herein to Private PSQ will include its subsidiaries to the extent reasonably applicable.

“Private PSQ Common Stock” means, collectively, the Common Stock, par value $0.001 per share, of Private PSQ prior to the Business Combination.

“Private PSQ Convertible Debt Notes” means the $22.5 million of 5% mandatorily convertible notes issued by Private PSQ in connection with the Permitted Financing and which converted into shares of PSQ Common Stock immediately prior to the Closing of the Business Combination.

“Private PSQ Convertible Securities” means, collectively, each outstanding option, warrant, convertible note or other right to subscribe or purchase any capital stock of Private PSQ or securities convertible into or exchangeable for, or that otherwise confer on the holder any right to acquire any capital stock of Private PSQ prior to the Closing of the Business Combination.

“Private PSQ Stockholders” refers to holders of Private PSQ Common Stock immediately prior to the Effective Time.

“Private Placement” means the private placement consummated simultaneously with the IPO in which Colombier issued the Private Warrants to the Colombier Sponsor at a purchase price of $1.00 per Private Warrant for aggregate consideration of $5,700,000.

“Private Warrants” means one (1) whole warrant entitling the holder thereof to purchase one (1) share of Class A Common Stock at a purchase price of $11.50 per share originally issued to the Colombier Sponsor in the Private Placement.

“PSQ Founder” means Michael Seifert, the current Chief Executive Officer of Private PSQ before the Closing and our current Founder, President, Chief Executive Officer and Chairman of the Board.

iv

“Public Warrants” means one (1) whole redeemable warrant that was included in as part of each Unit, entitling the holder thereof to purchase one (1) share of Class A Common Stock at a purchase price of $11.50 per share.

“Registration Rights Agreement” means the Amended and Restated Registration Rights Agreement, dated as of July 19, 2023, by and among Colombier, the Colombier Sponsor, Private PSQ and certain Private PSQ Stockholders party thereto.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Selling Holders” means the selling security holders identified in this prospectus and their permitted transferees.

“Sponsor Distributees” means the members of Colombier Sponsor at the time of the Closing.

“Trust Account” means the trust account of Colombier, established at the time of our IPO, containing the net proceeds of the sale of the Units in our IPO, including from overallotment securities sold by Colombier’s underwriters, and the sale of Private Warrants following the closing of our IPO.

“Units” means the units issued in our IPO consisting of one (1) share of Colombier Class A Common Stock and one-third (1/3) of one Public Warrant.

“Warrants” means Private Warrants and Public Warrants, collectively.

“Warrant Agent” means Continental Stock Transfer & Trust Company.

“Warrant Agreement” means that certain Warrant Agreement, dated June 8, 2021, between Colombier and Continental Stock Transfer & Trust Company, as Warrant Agent.

v

MARKET AND INDUSTRY DATA

This prospectus includes industry position, forecasts, market size and growth and other data that we obtained or derived from internal company reports, independent third-party reports and publications, surveys and studies by third parties and other industry data. Some data are also based on good faith estimates, which are derived from internal company research or analyses or review of internal company reports as well as the independent sources referred to above. Although we believe that the information on which we have based these estimates of industry position and industry data are generally reliable, the accuracy and completeness of this information is not guaranteed, and we have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Our internal reports have not been verified by any independent source. Statements as to industry position are based on market data currently available. While we are not aware of any misstatements regarding the industry data presented herein, these estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

vi

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus may constitute “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. This includes, without limitation, statements regarding expectations, hopes, beliefs, intentions, plans, prospects, financial results or strategies regarding us and the future held by our management team and the products and markets, future financial condition, expected future performance and market opportunities of our business. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this prospectus, forward-looking statements may be identified by the use of words such as “estimate,” “continue,” “could,” “may,” “might,” “possible,” “predict,” “should,” “would,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “designed to” or other similar expressions that predict or indicate future events or trends or that are not statements of historical facts. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

We caution readers of this prospectus that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, which could cause the actual results to differ materially from the expected results. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, projections of market opportunity and market share, potential benefits and the commercial attractiveness to our customers of products and services sold through our platform, the prospects of our recently launched direct-to-consumer (“D2C”) business and the potential success of our marketing and expansion strategies. These statements are based on various assumptions, whether or not identified in the prospectus, and on the current expectations of our management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. These forward-looking statements are subject to a number of risks and uncertainties, including:

• changes in the competitive industries and markets in which we operate or plan to operate;

• changes in applicable laws or regulations affecting our business;

• our ability to implement business plans, forecasts, and other expectations, and to identify and realize additional opportunities;

• risks related to our limited operating history, the rollout and/or expansion of our business and the timing of our expected business milestones;

• risks related to our potential inability to achieve or maintain profitability and generate significant revenue;

• current and future conditions in the global economy, including as a result of economic uncertainty, and its impact on us, our business and the markets in which we operate;

• our ability to retain existing advertisers and consumer and business members and attract new advertisers and consumer and business members;

• our potential inability to manage growth effectively;

• our ability to recruit, train and retain qualified personnel;

• estimates for the prospects and financial performance of our business may prove to be incorrect or materially different from actual results;

• risks related to future market adoption of our offerings;

• risks related to our marketing and growth strategies;

• the effects of competition on our business;

• our ability to meet the continued listing standards of the New York Stock Exchange;

vii

• expectations with respect to our future operating and financial performance and growth, including when we will generate positive cash flow from operations;

• our ability to raise funding on reasonable terms as necessary to develop our products in the timeframe contemplated by our business plan;

• our ability to execute our anticipated business plans and strategy; and

• other risks and uncertainties described in this prospectus, including those under the section entitled “Risk Factors.”

If any of these risks materialize or any of our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that we presently do not know or that we currently believe are immaterial that could also cause actual results to differ materially from those contained in the forward-looking statements. In addition, forward-looking statements reflect our expectations, plans or forecasts of future events and views as of the date of this prospectus. We anticipate that subsequent events and developments may cause our assessments to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our assessments as of any date subsequent to the date of this prospectus. Accordingly, undue reliance should not be placed upon the forward-looking statements. Actual results, performance or achievements may, and are likely to, differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements were based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as projected financial information and other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control. Forward-looking statements are not guarantees of performance. All forward-looking statements attributable to us or a person acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements.

viii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our Class A Common Stock or Warrants. You should read this entire prospectus carefully, including the matters discussed under the sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Condensed Combined Financial Information,” “Business” and the consolidated financial statements and related notes included elsewhere in this prospectus before making an investment decision.

Company Overview

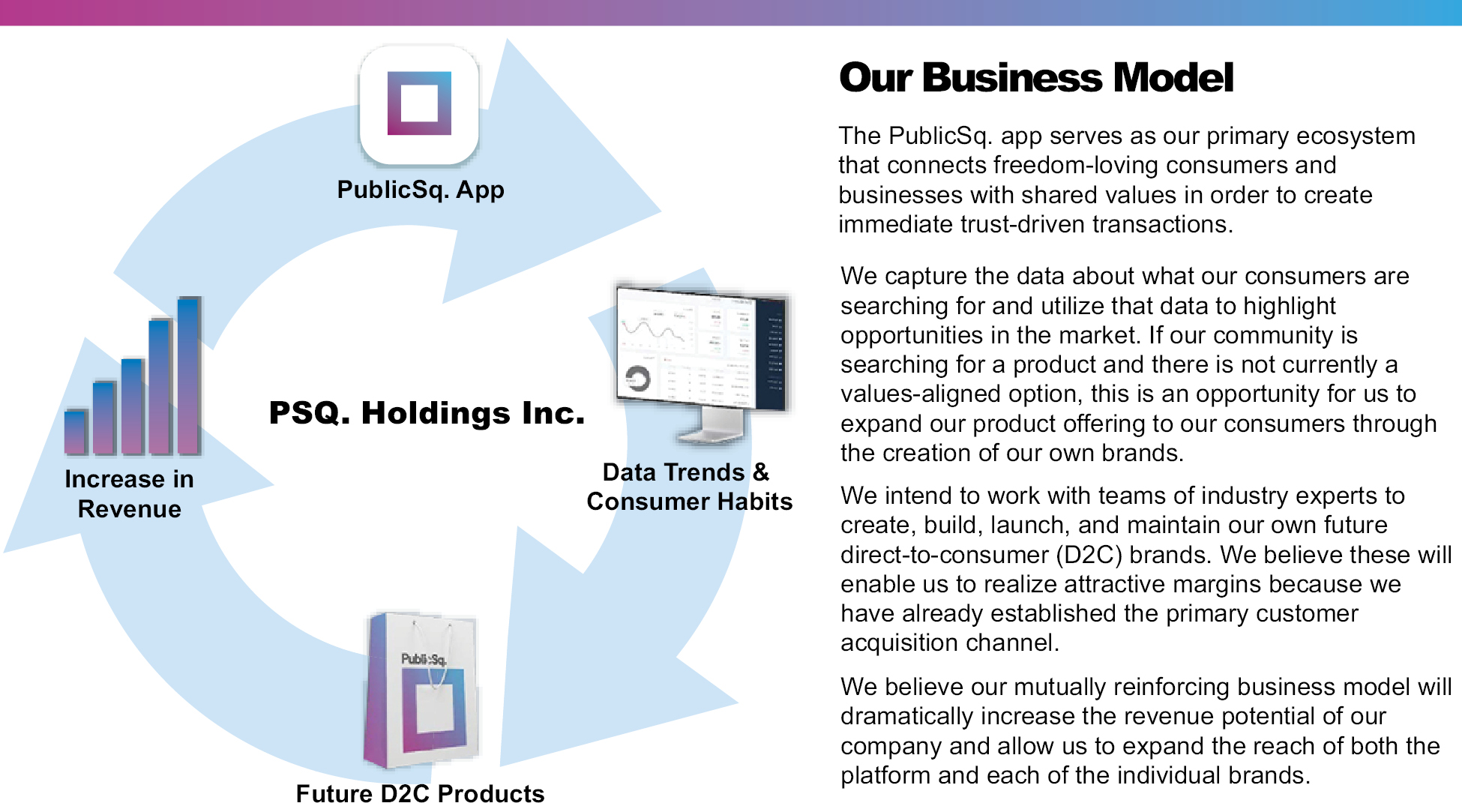

Our mission is to build the nation’s largest online platform dedicated to empowering like-minded, patriotic Americans to discover and support companies that share their values. The concept for our platform originated in early 2021 when Michael Seifert, our Founder, President, Chief Executive Officer and Chairman of the Board, after perceiving that many corporations were increasingly embracing progressive and highly-politicized priorities, as demonstrated by advertising, corporate philosophies, and company donations, was inspired to help create a “parallel economy” where consumer members with priorities that we consider reflective of traditional American values could connect with and patronize business members whose values align with their own. We originally incorporated PublicSq. Inc. (f/k/a PSQ Holdings, Inc.) (“Private PSQ”) in February of 2021, began development of our digital platform (mobile app and website) in May 2021, and launched our initial product regionally in San Diego County, California in October 2021 on iOS, Android, and on our website. After 10 months of testing in various markets and courting member feedback, we launched the PSQ platform nationwide on July 4, 2022. We release updates to the platform frequently and we consistently seek the feedback of our community, prioritize transparency about our goals and operations, and regularly develop our product offering to better meet the needs of the consumer members and business members on our platform. In July 2023, we commercially launched our first D2C product offering, disposable diapers and wipes under our pro-family “EveryLifeTM” brand. We continue to evaluate additional D2C opportunities and expect to expand and diversify our branded D2C offerings in areas where we believe there is significant existing market need in the future.

Our Values

We are passionate about our mission and that passion guides everything we do. We believe that our platform is the leading widely accessible repository dedicated to empowering like-minded, patriotic Americans to discover and support companies that share their values. As a company, we strive to connect consumer members with a wide selection of values-aligned and patriotic business members from a wide variety of industries. In order for a new business to join our platform, a representative of that business must agree that the business will respect the following five core values (the “five core values”) that we strive to uphold and promote within our community:

• We are united in our commitment to freedom and truth — that’s what makes us Americans.

• We will always protect the family unit and celebrate the sanctity of every life.

• We believe small business members and the communities who support them are the backbone of our economy.

• We believe in the greatness of the United States of America and will always fight to defend it.

• Our constitution is non-negotiable — government isn’t the source of our rights, so it can’t take them away.

These five core values are the foundation of our vision, which connects the consumer members and business members who use our platform to promote their voice through their purchasing power, or ‘vote with their wallet’.

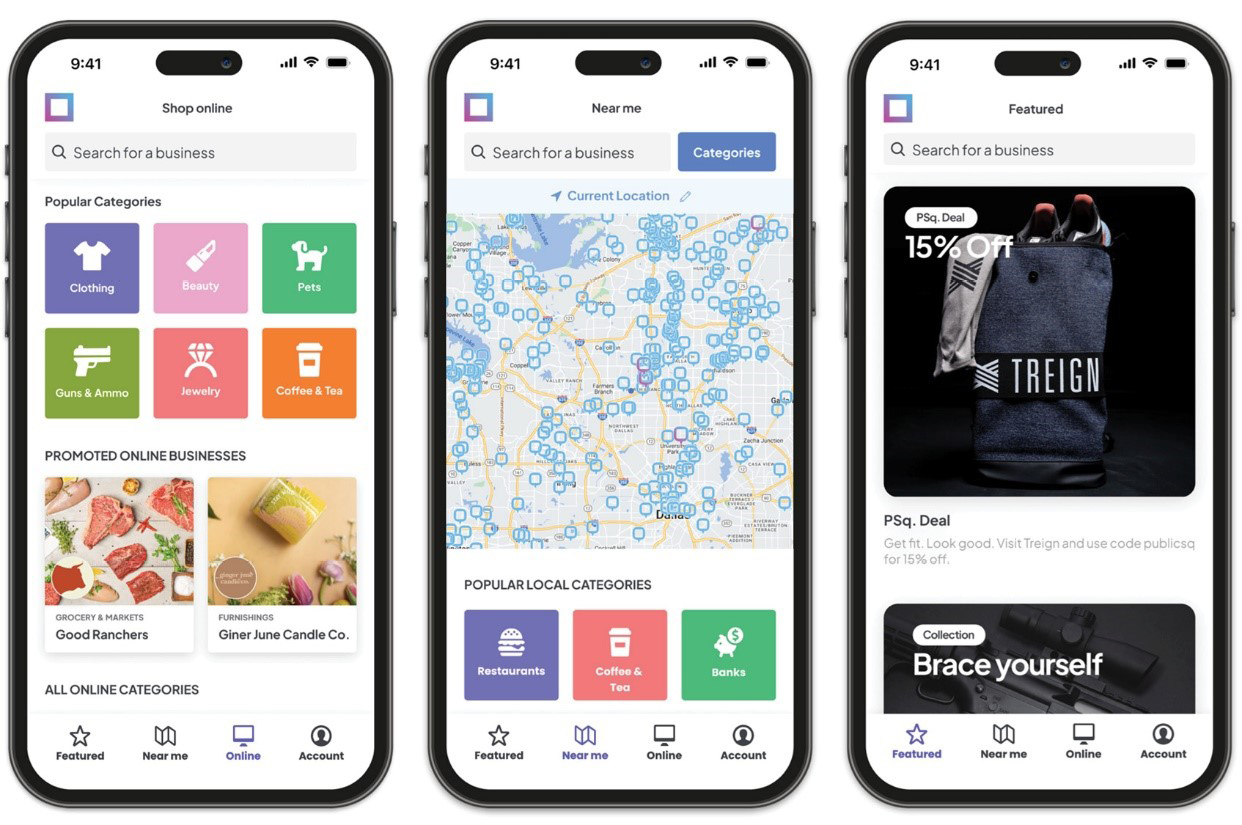

Our Platform

We are free-to-use for consumer members, who can use our platform to search for and shop from values-aligned business members both locally and nationally. The types of business members found on our platform currently include, among others, retailers and other merchants, restaurants, banks and other service providers.

1

Our platform can be accessed through two primary means:

• Mobile application — Our mobile app is available for both iOS and Android-based devices.

• Web — Members can access our full platform at publicsq.com.

In addition to our current platform directory, we are in the process of developing e-commerce capabilities on our platform that will provide consumer members with in-app shopping capabilities and allow them to purchase their favorite products and services directly within our app. We expect, in the near future, to partner with one or more third party payment platforms to support this functionality on our website and mobile app.

Our Growth Strategy

We are currently focusing on the following areas to drive our growth:

• Continue to Innovate and Improve our Platform Offering — We are continuously looking to improve our platform functionality and user experience, and to add new features and technologies to improve our platform and value proposition. We recently introduced an improved user interface and user experience that we expect will continue to serve our existing app users, attract new app users to our platform and grow application engagement with the availability of the e-commerce interface. We are in the process of rolling out an enhanced e-commerce platform, where our consumer members will be able to purchase products from our business members directly through our app and through which we will be able to realize transaction-based revenue fees through purchases being made using our platform.

• Expand Our Outreach Program — Growth in our consumer member base is an important driver for our business’ growth, and we believe that there is a significant opportunity to expand the number of consumer members and business members using our platform. Through our “Outreach Program,” we are collaborating with over 600 highly influential individuals, as of July 31, 2023, who serve as our ambassadors and influencers to raise awareness about and advocate for our platform and our five core values. We believe that our Outreach Program is key to growing our awareness and presence in the digital world. Participating influencers share their positive interactions with our platform and the various experiences connecting with patriotic business members that use our platform. Through media outreach, our ambassadors are able to actively onboard new business and consumer members on our platform. We actively seek to continue growing this program.

• Introduce Our Branded D2C Product Offerings — In July 2023, we commercially launched our first D2C product offering, disposable diapers and wipes, under our pro-family “EveryLifeTM” brand. We continue to evaluate additional D2C opportunities and expect to expand and diversify our branded D2C offerings in areas where we believe there is significant existing market need in the future. We believe these brands will enable us to fill gaps within consumer spending through our established primary customer acquisition channel.

• Increase Monetization on our Platform — We are still in the early stages of monetization on our platform and believe there are many avenues for sustained revenue growth that may be available to us in the future through our platform and the network of connections that it allows us to establish and grow. We have, however, incurred net losses since our inception and may not be able to monetize our platform or achieve or maintain profitability in the future. We incurred net losses of $20.7 million and $27.4 million for the three-and six-months ended June 30, 2023, respectively, net losses of $7.0 million for the year ended December 31, 2022, and net losses of $1.9 million for the period from February 25, 2021 (inception) through December 31, 2021. We are currently focused on near-term goals in two main areas — scaling our digital advertising business and developing new revenue streams, such as our e-commerce integration and the development and launch of our own business-to-business (“B2B”) offerings and the expansion of our D2C product offerings.

• Pursue Value-Enhancing Acquisitions — In order to fully capitalize on opportunities within our addressable market, as well as to further expand our platform and offerings, we intend, over time, to pursue value-enhancing acquisitions as they become available in the future. In so doing, we intend to focus on like-minded business members that respect our five core values, complement our values-aligned platform, and fulfil demand from our consumer members and business partners.

2

Corporate Information

PSQ Holdings, Inc. is a Delaware corporation. Our principal executive offices are located at 250 S. Australian Avenue, Suite 1300, West Palm Beach, Florida 33401, and our telephone number is (877) 776-2402. Our principal website address is https://publicsq.com/. Information contained in, or accessible through, our website is not a part of, and is not incorporated into, this prospectus.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company” (“EGC”), as defined in the Jumpstart Our Business Startups Act of 2012. We may remain an EGC until the last day of the fiscal year following the fifth anniversary of the consummation of our IPO, although if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30 before that time or if we have annual gross revenues of $1.235 billion or more in any fiscal year, we would cease to be an EGC as of December 31 of the applicable year. We also would cease to be an EGC if we issue more than $1 billion of non-convertible debt over a three-year period. For so long as we remain an EGC, we are permitted and intend to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not EGCs. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

We are also a “smaller reporting company,” as defined in Rule 12b-2 promulgated under the Exchange Act. We may continue to be a smaller reporting company if either (1) the market value of our stock held by non-affiliates is less than $250 million or (2) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our stock held by non-affiliates is less than $700 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. For so long as we remain a smaller reporting company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not smaller reporting companies.

Controlled Company Exemption

Michael Seifert, our Founder, President and Chief Executive Officer and Chairman of the Board, as a result of his ownership of all of the shares of our outstanding Class C Common Stock, owns 52.81% of our outstanding voting power for the election of directors as of the date of this prospectus. As a result, we are a “controlled company” within the meaning of applicable NYSE rules as of the date of this prospectus and, consequently, qualify for exemptions from certain corporate governance requirements. Our stockholders do not have the same protections afforded to stockholders of companies that are subject to such requirements. Please see the section entitled “Management — Controlled Company”.

Risk Factor Summary

Our business is subject to numerous risks and uncertainties, including those highlighted in the section entitled “Risk Factors” immediately following this prospectus summary, that represent challenges that we face in connection with the successful implementation of our strategy and the growth of our business. In particular, the following considerations, among others, may offset our competitive strengths or have a negative effect on our business strategy, which could cause a decline in the price of shares of our Class A Common Stock or Warrants and result in a loss of all or a portion of your investment:

• We may not continue to grow or maintain our base of consumer and business members or advertisers and may not be able to achieve or maintain profitability.

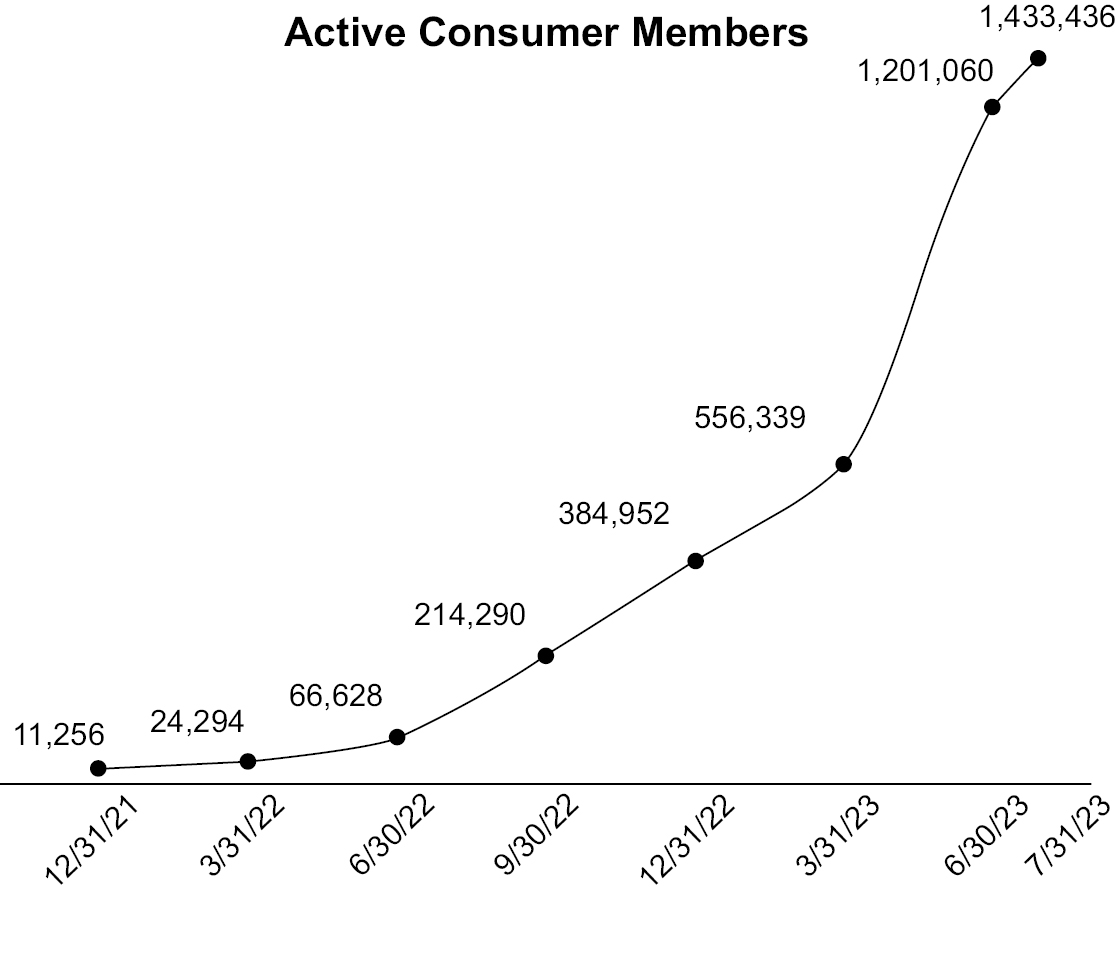

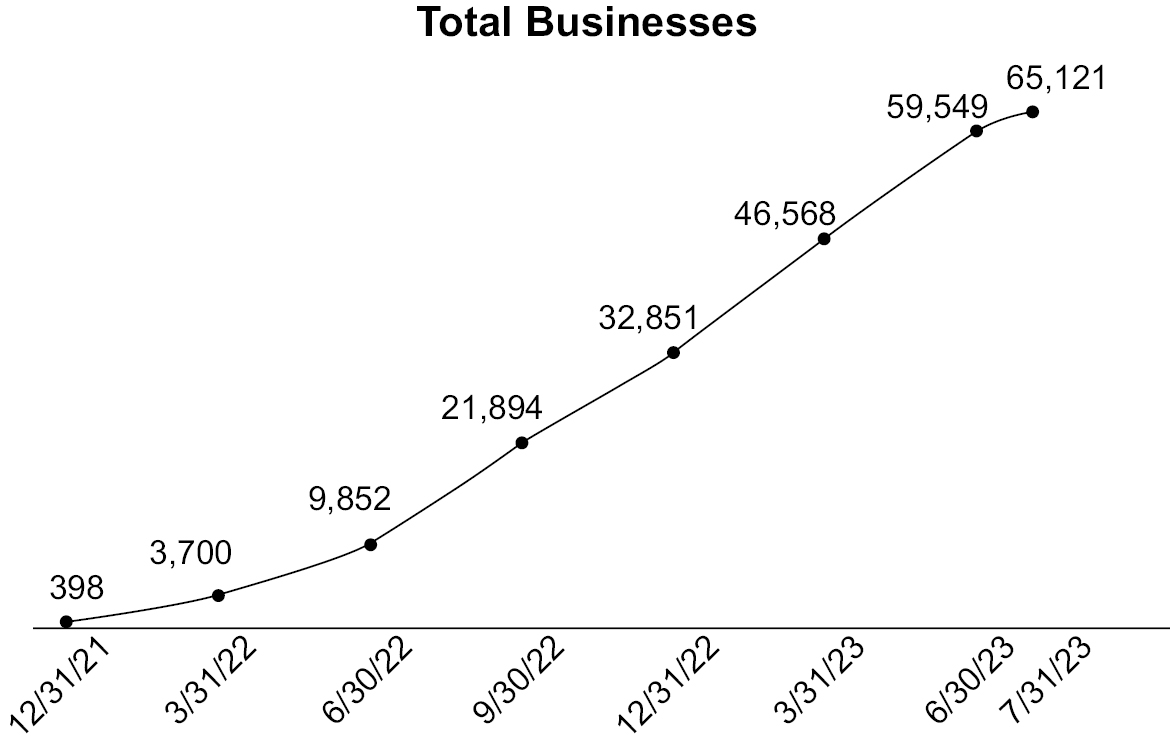

• Our recent and rapid growth in platform participants may not be sustainable or indicative of future performance.

• The market for our platform and services may not be as large as we believe it to be, presently or in the future.

• We have limited experience with respect to determining optimal prices and pricing structure for our products and services, which may impact our financial results.

3

• Our business faces significant competition, and if we are unable to compete effectively, our business and operating results could be materially and adversely affected.

• The anticipated expansion of our operations, including in areas not part of our current operations, subjects us to additional risks that can adversely affect our operating results.

• Our business depends on hiring, developing and retaining highly skilled and dedicated employees, and any failure to do so, could have a material adverse effect on our business.

• Consumer tastes and preferences change over time and from time to time, as may public perception of us, which could be adversely affected by any negative publicity or reputational effects attributable to us or any of our affiliates or Outreach Program participants, which may impact our consumer and business members’ desire to utilize our platform and materially affect our business and operating results.

• If we cannot maintain our company culture as we grow, our success, business and competitive position may be harmed.

• Our success depends on establishing and maintaining a strong brand and active engagement by business and consumer members and advertisers on our platform, and any failure to establish and maintain a strong brand and member base, or adverse change in advertisers’ willingness to pay for advertising on our platform, would adversely affect our future growth prospects.

• Our success depends on establishing and maintaining a strong brand and base of business and consumer members actively on our platform, and any failure to establish and maintain a strong brand or member base would adversely affect our future growth prospects.

• Our five core values may not always align with the interests of our business or our stockholders.

• Any failure by us to attract advertisers or any change in or loss of relationships with our existing advertisers or the amounts advertisers are able or willing to spend to advertise on our platform could adversely affect our business and results of operations.

• If member engagement by business or consumer members on our platform fails to increase or declines, we may not be able to maintain or expand our advertising revenue and our business and operating results will be harmed.

• Changes to our existing platform and services could fail to attract engagement by consumer and business members with, or advertising spending on, our platform, which could materially affect our ability to generate revenues.

• We may not be able to able to expand into or to compete successfully in one or more of the highly competitive business areas in which we anticipate expanding, including e-commerce and the B2B market, or recently expanded into, including the D2C market that we recently entered into with our launch of EveryLife in July 2023.

• We are subject to payments-related risks.

• Uncertain global macro-economic and political conditions could materially adversely affect our results of operations and financial condition.

• We may in the future make acquisitions, and such acquisitions could disrupt our operations, and may have an adverse effect on our operating results.

• We are or may be subject to numerous risks relating to the need to comply with data and information privacy laws.

• We are subject to cybersecurity risks and interruptions or failures in our information technology systems and as we grow, we will need to expend additional resources to enhance our protection from such risks.

4

• If we fail to adequately protect our proprietary intellectual property (“IP”) rights, our competitive position could be impaired and we may lose valuable assets, generate reduced revenue and incur costly litigation to protect our rights.

• Our business depends on continued and unimpeded access to our directory information and services on the internet, which in turn relies on third-party telecommunications and internet service providers.

• We may be unable to successfully grow our business if we fail to compete effectively with others to attract and retain our executive officers and other key management and technical personnel.

• We may be exposed to risk if we cannot enhance, maintain, and adhere to our internal controls and procedures.

• Our independent registered public accounting firm’s report contains an explanatory paragraph that expresses substantial doubt about our ability to continue as a “going concern.”

• Litigation or legal proceedings could expose us to significant liabilities and have a negative impact on our reputation or business.

• Compliance obligations imposed by new privacy laws, laws regulating social media platforms and online speech in the U.S., or industry practices may adversely affect our business.

• We are a “controlled company” within the meaning of NYSE listing standards and comply with reduced corporate governance standards as a result.

• Natural disasters, including and not limited to unusual weather conditions, epidemic outbreaks, terrorist acts and political events could disrupt our business schedule.

• We may require substantial additional funding to finance our operations, but adequate additional financing may not be available when we need it, on acceptable terms or at all.

• A significant number of shares of our Class A Common Stock and the Private Warrants will be available for public resale by the Selling Holders and, subject to the Lock-Up Period in the case of the shares of Class A Common Stock constituting the Colombier Sponsor Shares (but not the Private Warrants or shares of Class A Common Stock issuable upon exercise thereof), may be sold into the market in the future upon effectiveness of the registration statement of which this prospectus forms part. The Selling Holders purchased the securities covered by this prospectus at different prices than prices paid by investors who purchased our securities in our IPO or in the public markets, and the prices paid by the Selling Holders were significantly below the current trading price of our securities. Sales of our Class A Common Stock by the Selling Holders, or the perception that such sales may occur, may cause the market price of our Class A Common Stock to decline, perhaps significantly, even if our business is doing well.

5

THE OFFERING

We are registering the issuance by us of up to 11,450,000 shares of our Class A Common Stock that may be issued upon exercise of the Warrants to purchase Class A Common Stock, including the 5,750,000 Public Warrants to purchase Class A Common Stock issued as part of the Units in our IPO and the 5,700,000 Private Warrants issued to the Colombier Sponsor in the Private Placement at a purchase price of $1.00 per Private Warrant. In addition, we are also registering the offer and sale, from time to time, by the Selling Holders of (i) up to 4,312,500 shares of Class A Common Stock currently outstanding that were issued upon conversion of the Colombier Class B Common Stock in connection with the Closing of the Business Combination, or the Colombier Sponsor Shares, which were originally acquired by the Colombier Sponsor for an aggregate purchase price of $25,000, or approximately $0.006 per share, and subsequently distributed by the Colombier Sponsor to the Sponsor Distributees for no additional consideration, (ii) up to 5,700,000 Private Warrants issued to the Colombier Sponsor in the Private Placement at a purchase price of $1.00 per Private Warrant and (iii) up to 5,700,000 shares of Class A Common Stock issuable upon the exercise of Private Warrants. The Warrants have an exercise price of $11.50 per share. The Public Warrants are generally exercisable only for cash, subject to the right of holders to exercise the Public Warrants on a cashless basis under certain limited circumstances provided for in the Warrant Agreement relating to the Warrants. The Private Warrants are exercisable by the Colombier Sponsor, the Sponsor Distributees and certain other permitted transferees on a cashless basis as provided in the Warrant Agreement. The following information is as of October 3, 2023 and does not give effect to issuances of our Class A Common Stock, warrants or options to purchase shares of our Class A Common Stock after such date, or any exercise of warrants or options after such date.

Issuance of Class A Common Stock

|

Issuer |

PSQ Holdings, Inc. |

|

|

Shares of our Class A Common Stock to be issued upon exercise of all Public Warrants and Private Warrants |

11,450,000 shares |

|

|

Shares of our Class A Common Stock outstanding prior to (i) the exercise of all Public Warrants and Private Warrants, (ii) any issuance of Earnout Shares and (iii) any issuance of shares of Class A Common Stock under the EIP and ESPP |

24,340,075 shares |

|

|

Use of Proceeds |

We may receive aggregate gross proceeds of approximately $131.7 million from the exercise of all Public Warrants and Private Warrants, assuming the exercise in full of all such Warrants for cash. The exercise of Warrants, and any proceeds we may receive from their exercise, are highly dependent on the price of our Class A common stock and the spread between the exercise price of the Warrant and the price of our Class A common stock at the time of exercise. For example, to the extent that the price of our Class A common stock exceeds $11.50 per share, it is more likely that holders of our Warrants will exercise their warrants. If the price of our Class A common stock is less than $11.50 per share, we believe it is much less likely that such holders will exercise their warrants. The $8.45 closing price per share of our Class A Common Stock as reported by the NYSE on October 3, 2023 was less than the $11.50 exercise price per share of the Warrants. There can be no assurance that our Warrants will be in the money after the date of this prospectus and prior to their expiration. Our Sponsor and the Sponsor Distributees have the option to exercise the Private Warrants on a cashless basis. Holders of Public Warrants may generally only exercise such Warrants for cash, subject to very limited exceptions in certain circumstances as provided for in the Warrant Agreement relating to the Warrants. |

6

|

Unless we inform you otherwise in a prospectus supplement or free writing prospectus, we intend to use the net proceeds, if any, from the exercise of such Warrants for general corporate purposes, which may include: (i) funding our D2C inventory and supply chain requirements; (ii) supporting our D2C and B2B operating expenses, including marketing and payroll; (iii) funding an increase in our payroll in the areas of engineering and product for the further development of our platform’s functionality, including the enhancement of e-commerce capabilities, consumer rewards programs, and platform scalability; (iv) launching targeted marketing initiatives, including brand awareness campaigns, direct-response advertising, promotional events, and the expansion of our Outreach Program; and (v) for other general corporate purposes including, but not limited to, working capital for operations and potential future acquisitions. We will pay the expenses associated with registering the sales by the selling stockholders, as described under “Use of Proceeds” and “Plan of Distribution” elsewhere in this prospectus. |

||

|

Risk Factors |

See “Risk Factors” on page 10 of this prospectus and the documents referenced in that section for a discussion of factors you should carefully consider before deciding to invest in shares of our Class A Common Stock. |

|

|

Resale of Class A Common Stock and |

||

|

Shares of Class A Common Stock offered by the Selling Holders 10,012,500 shares of Class A Common Stock (including 4,312,500 shares of Class A Common Stock currently outstanding that were issued upon conversion of the Colombier Class B Common Stock in connection with the Closing of the Business Combination, or the Colombier Sponsor Shares, and up to 5,700,000 shares of Class A Common Stock issuable upon the exercise of outstanding Private Warrants) |

|

|

|

Private Warrants offered by the Selling |

|

|

|

Exercise Price |

$11.50 per share, subject to adjustment as described herein |

|

|

Redemption |

The Warrants are redeemable in certain circumstances. See “Description of Securities — Warrants” for further discussion. |

|

|

Use of Proceeds |

We will not receive any proceeds from the sale of the Class A Common Stock and Private Warrants to be offered by the Selling Holders. |

|

7

|

Lock-Up |

Subject to certain customary exceptions, the Class A Common Stock held by each of the Colombier Sponsor, the Sponsor Distributees and the former directors and officers of Colombier and which were issued upon conversion of the Colombier Class B Common Stock in connection with the Closing of the Business Combination are subject to certain restrictions on transfer until July 19, 2024 (the “Lock-Up Period”), the one-year anniversary of the Closing Date, subject to early release if the closing price of our Class A Common Stock has equaled or exceeded $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any twenty (20) trading days within any 30-trading day period commencing at least 150 days after the Closing of the Business Combination, or, in the case of Private Warrants. The Private Warrants (including the Class A Common Stock issuable upon exercise of the Private Warrants) were not transferable, assignable or salable until 30 days after the Closing of the Business Combination. Such restrictions on transfer of the Private Warrants and the Class A Common Stock issuable upon exercise of the Private Warrants have expired, and accordingly the Private Warrants and such underlying shares of Class A Common Stock are currently transferrable, assignable and salable. See “Securities Act Restrictions on Resale of Securities — Lock-Up Agreements” for further discussion. |

|

|

NYSE Ticker Symbols |

Class A Common Stock: “PSQH” Warrants: “PSQH.WS” |

8

MARKET PRICE, TICKER SYMBOLS AND DIVIDEND INFORMATION

Market Price and Ticker Symbols

Our Class A Common Stock and Public Warrants are currently listed on NYSE under the symbols “PSQH” and “PSQH.WS,” respectively.

The closing price of our Class A Common Stock and Public Warrants as reported by the NYSE on October 3, 2023, was $8.45 and $1.17, respectively.

Holders

As of October 3, 2023, there were 49 holders of record of our Class A Common Stock and one holder of record of our Public Warrants. A substantially greater number of holders are “street name” or beneficial holders, whose shares of record are held by banks, brokers, and other financial institutions.

Dividend Policy

We have not paid any cash dividends on our Class A Common Stock to date. It is the present intention of our Board to retain all earnings, if any, for use in our business operations and, accordingly, our Board does not anticipate declaring any dividends in the foreseeable future. The payment of cash dividends in the future will be dependent upon our revenues and earnings, if any, capital requirements and general financial condition. The payment of any cash dividends is within the discretion of our Board. Further, our ability to declare dividends may be limited by the terms of financing or other agreements entered into by us or our subsidiaries from time to time.

9

RISK FACTORS

An investment in our Class A Common Stock and Warrants involves a high degree of risk. You should carefully consider the risks described below before making an investment decision. Our business, prospects, financial condition or operating results could be harmed by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of our Class A Common Stock and Warrants could decline due to any of these risks, and, as a result, you may lose all or part of your investment.

In the course of conducting our business operations, we are exposed to a variety of risks. Any of the risk factors we describe below have affected or could materially adversely affect our business, financial condition and results of operations. The market price of our securities could decline, possibly significantly or permanently, if one or more of these risks and uncertainties occurs. Certain statements in “Risk Factors” are forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Financial Performance and Operation Risks Related to Our Business

We have a very limited operating history, which makes it difficult to evaluate our business and prospects.

We have a very limited operating history, which makes it difficult to evaluate our business and prospects or forecast our future results. We are subject to the same risks and uncertainties frequently encountered by new companies in rapidly evolving markets. Our financial results in any given quarter can be influenced by numerous factors, many of which we are unable to predict or are outside of our control, including:

• market adoption of our platform;

• our ability to maintain and grow our platform offerings, traffic, and engagement;

• our ability to attract and retain consumers and business members and advertisers;

• the success of our Outreach Program;

• the amount of advertising we can attract to our platform and the pricing of our advertising products;

• the diversification and growth of our revenue sources beyond current sources, including our ability to successfully launch new products and realize revenues from increased e-commerce functionality on our platform, including through consumer transactions executed in our platform, and through the sale of our own D2C branded products;

• our ability to grow and generate revenue from our B2B offerings once launched;

• the development and introduction of new products, or services by us or our competitors;

• increases in marketing, sales, and other operating expenses that we may incur to grow and expand our operations and to remain competitive, and increased expenses we have incurred and will continue to incur as a public company;

• legislation and regulation that forces us to change our content policies and practices (including those relating to our products, services and advertisements of our business members);

• our ability to maintain and increase gross margins and operating margins;

• system failures or breaches of security or privacy;

• competition in the markets in which we operate, and our ability to successfully compete; and

• negative publicity we may encounter as we seek to grow our values-focused business.

10

To date, we have not generated significant revenues or achieved profitability, and may never generate significant revenues or become profitable.

We have incurred net losses since our inception, and we may not be able to achieve or maintain profitability in the future. We incurred net losses of $20.7 million and $27.4 million for the three- and six-months ended June 30, 2023, respectively, $7.0 million for the year ended December 31, 2022, and net losses of $1.9 million for the period from February 25, 2021 (inception) through December 31, 2021. We generated revenue of $0.5 million and $0.9 million for the three- and six-months ended June 30, 2023, respectively, revenue of $0.5 million for the year ended December 31, 2022, and revenue of $7 thousand for the period from February 25, 2021 (inception) through December 31, 2021. Our expenses will likely increase in the future as we develop and launch new offerings and platform features, expand in existing and new markets, increase our sales and marketing efforts and continue to invest in our platform, as well as a result of our becoming a public company. Our efforts to grow our business may be more costly than we expect and may not result in increased revenue or growth in our business. We may be required to make significant capital investments and incur recurring or new costs, and our investments may not generate sufficient returns and our results of operations, financial condition and liquidity may be adversely affected. Any failure to increase our revenue sufficiently to keep pace with our investments and other expenses could prevent us from achieving or maintaining profitability or positive cash flow on a consistent basis or at all. If we are unable to successfully address these risks and challenges as we encounter them, our business, financial condition, results of operations and prospects could be adversely affected. If we are unable to generate adequate revenue growth and manage our expenses, we may continue to incur net losses in the future, which may be substantial, and we may never be able to achieve or maintain profitability. We also expect our costs and expenses to increase in future periods, which could negatively affect our future results of operations if our revenue does not increase. In particular, we intend to continue to expend significant funds to further develop our platform. We will also face increased compliance costs associated with growth, the expansion of our business and consumer member base, and being a public company. Our efforts to grow our business may be more costly than we expect, or the rate of our growth in revenue may be slower than we expect, and we may not be able to increase our revenue enough to offset our increased operating expenses. We may incur significant losses in the future for a number of reasons, including the other risks described herein, and unforeseen expenses, difficulties, complications or delays, and other unknown events. If we are unable to achieve and sustain profitability, the value of our business may significantly decrease.

We believe there is a significant market opportunity for our business, and we intend to invest aggressively to capitalize on this opportunity. These efforts may be more costly than we expect and may not result in increased revenue or growth in our business. Any failure to increase our revenue sufficiently to keep pace with our investments and other expenses could prevent us from achieving or maintaining profitability or positive cash flow. Furthermore, if our future growth and operating performance fail to meet investor or analyst expectations, or if we have future negative cash flow or losses resulting from our investment in acquiring platform consumers and businesses or expanding our operations, this could have a material adverse effect on our business, financial condition and results of operations. We cannot assure you that we will ever achieve or sustain profitability and may continue to incur significant losses going forward. Any failure by us to achieve or sustain profitability on a consistent basis could cause the value of our Class A Common Stock and Private Warrants to decline.

Inflationary pressures, particularly in the United States, could have a material adverse effect on our business, cash flows and results of operations. The U.S. economy is currently experiencing a bout of inflation, in part due a collision of booming demand with constrained supply, forcing prices to rise. To combat inflation, the U.S. Federal Reserve as well as counterparts in other countries have made a series of aggressive interest rate hikes commencing in 2022 and extending into early 2023 in an attempt to cool global economies. Inflation did not have a significant impact on our results of operations for the three- and six-months ended June 30, 2023, the year ended December 31, 2022 or for the period from February 25, 2021 (inception) through December 31, 2021. We anticipate a material increase in labor, cost of sales and operating expenses for at least the remainder of 2023, if not longer.

We may require substantial additional funding to finance our operations, but adequate additional financing may not be available when we need it, on acceptable terms or at all.